NOTES TO

FINANCIAL STATEMENTS

December 31, 2015

117

CITIC ENVIROTECH LTD.

Annual

Report

2015

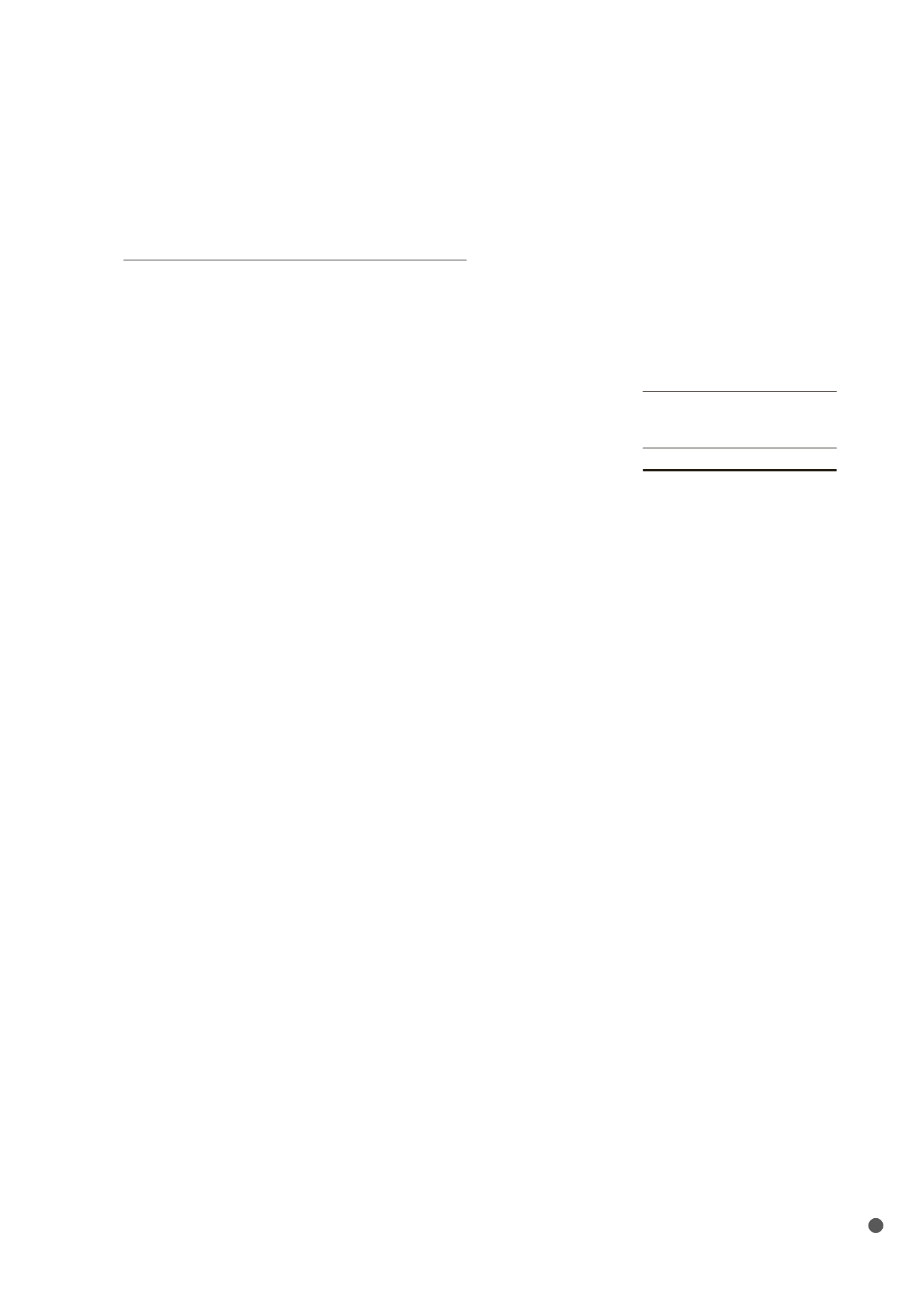

24 MEDIUM TERM NOTES (cont’d)

Presentation on Statements of Financial Position:

Group

December

31,

March

31,

2015

2015

$’000

$’000

Current liabilities

97,700

–

Non-current liabilities

222,226

98,228

Total

319,926

98,228

During the year ended March 31, 2014, the Company established the Medium Term Note

programme (the “MTN programme”) with aggregate nominal value of US$300,000,000, of which

$50,000,000, $15,000,000 and $35,000,000 were issued on September 2, 2013, October 7, 2013 and

February 4, 2014 from the MTN programme (the “Notes”) under Series 001 and the Notes carried

fixed interest of 7.25% per annum with interest payable on March 2 and September 2 of each year.

The Notes will mature on September 2, 2016.

On April 10, 2015, the Company increased the maximum aggregate nominal value of the Notes from

US$300,000,000 to US$500,000,000.

On April 29, 2015, the Company issued additional Notes of $225,000,000 under Series 002 and the

Notes carried fixed interest of 4.70% per annum with interest payable on April 29 and October 29 of

each year. The Notes will mature on April 29, 2018.

The Notes are unsecured and are listed on the Singapore Exchange Securities Trading Limited.

Prior to the maturity of the Notes, the Company may redeem the Notes based on the stipulated

redemption price on the occurrence of the early redemption condition stated in the pricing

supplement. Early redemption conditions for the Notes are:

additional tax obligation to the Company due to any change in, or amendment to, the laws or

regulation of Singapore;

on event of default; and

change in control of the Company.

The Notes contained certain covenants that limited the Group’s abilities to, among other things:

incur additional indebtedness;

maintain certain level of earnings ratio;

maintain certain level of total shareholders’ equity; and

declare dividends exceeding a certain ratio to the consolidated profit after tax.

Management estimated the fair value of the Notes at December 31, 2015 to be approximately

$326,025,000 (March 31, 2015 : $99,950,000). The fair value is based on the bid price extracted from

Bloomberg as at December 31, 2015 and management determined the Notes to be under Level 2

fair value hierarchy.