NOTES TO

FINANCIAL STATEMENTS

December 31, 2015

115

CITIC ENVIROTECH LTD.

Annual

Report

2015

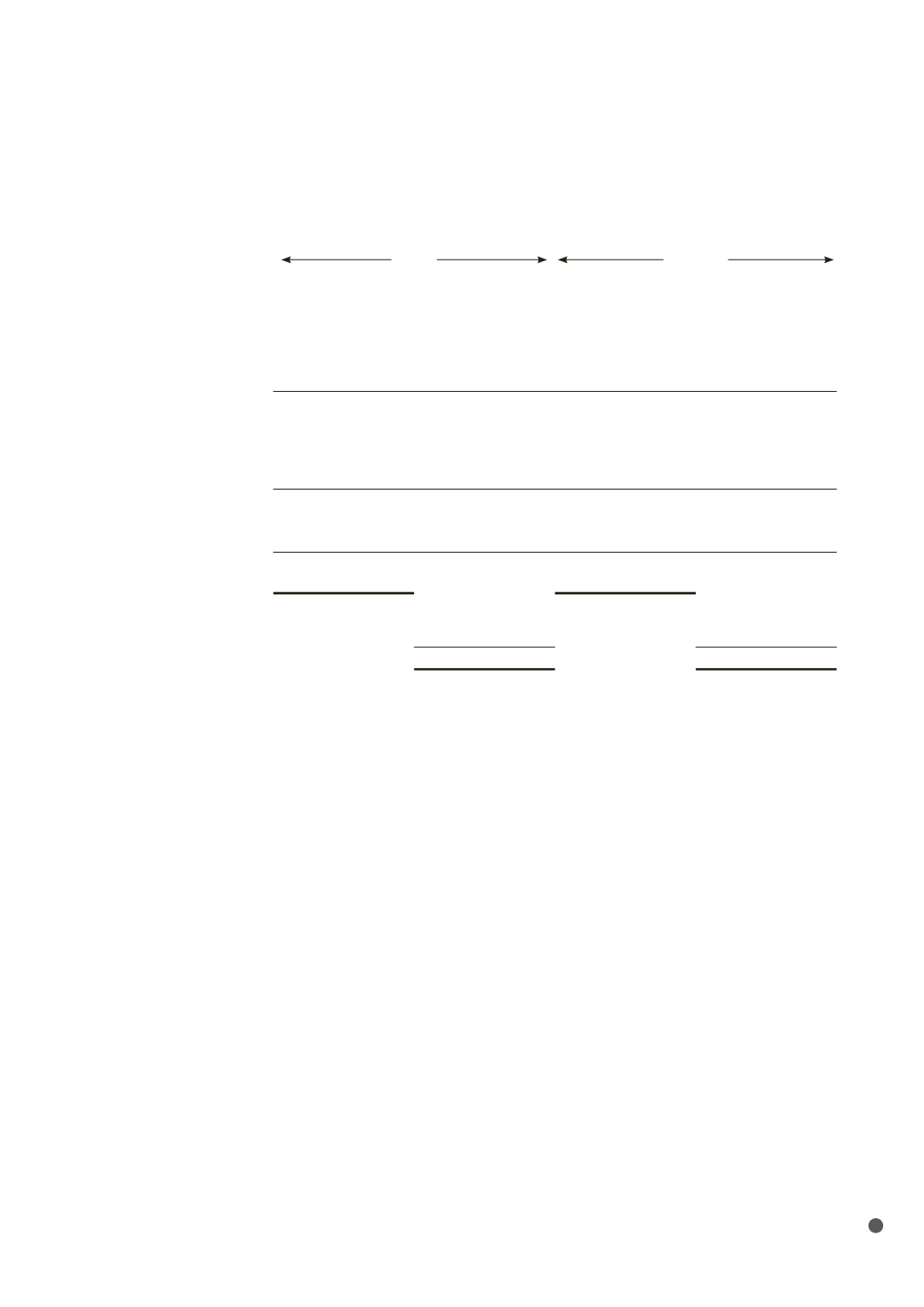

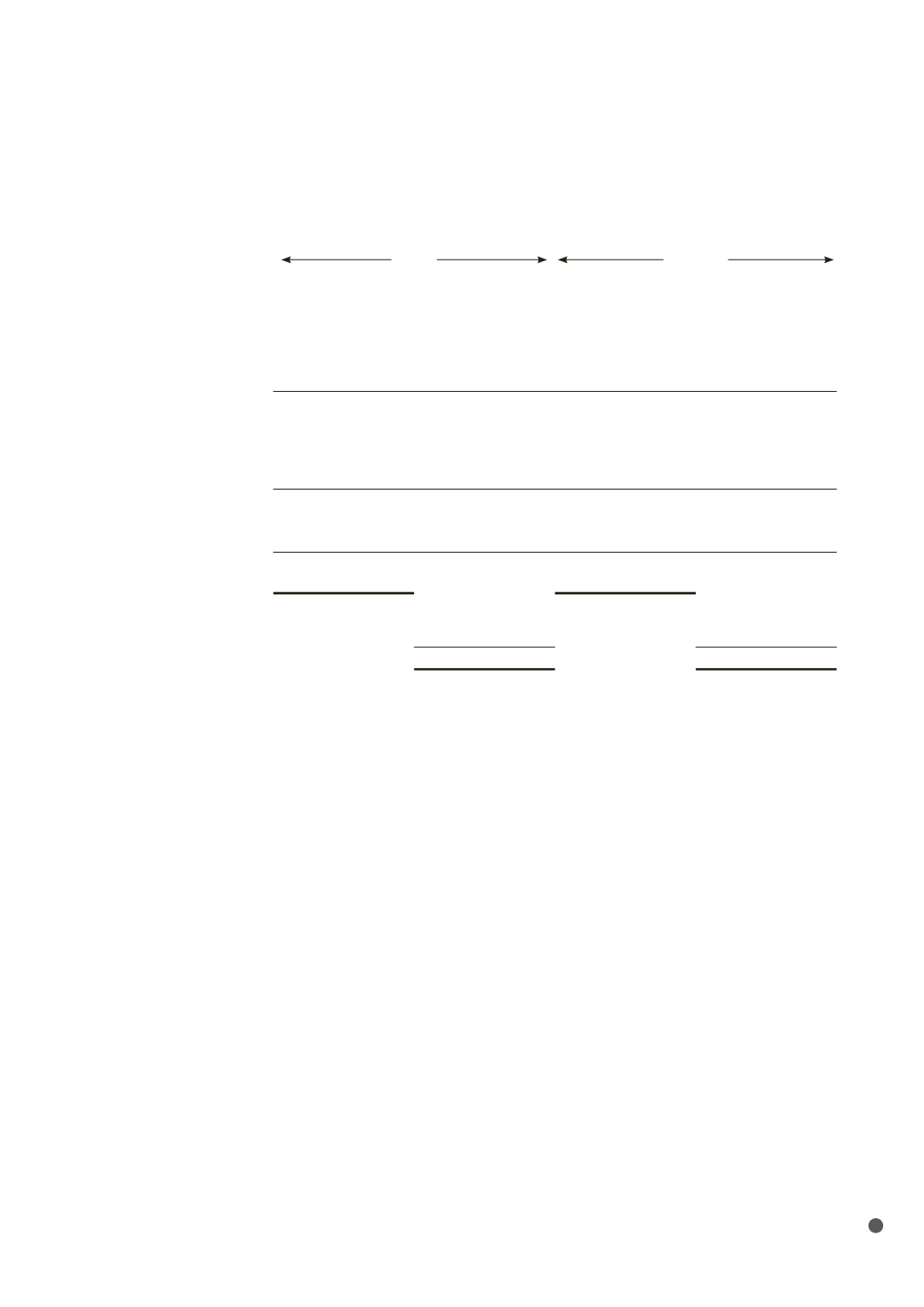

22 FINANCE LEASES

Group

Company

Present value

Present value

Minimum

lease payments

of minimum

lease payments

Minimum

lease payments

of minimum

lease payments

December

31, 2015

$’000

March

31, 2015

$’000

December

31, 2015

$’000

March

31, 2015

$’000

December

31, 2015

$’000

March

31, 2015

$’000

December

31, 2015

$’000

March

31, 2015

$’000

Within one year

114

55

180

47

26

22

17

16

In the second to fifth

year inclusive

356

173

218

148

96

86

76

73

After the fifth year

21

32

38

32

7

23

7

23

Total

491

260

436

227

129

131

100

112

Less: Future finance

charges

(55)

(33)

NA

NA

(29)

(19)

NA

NA

Present value of lease

obligations

436

227

436

227

100

112

100

112

Less: Due within one

year

(180)

(47)

(17)

(16)

Due after one year

256

180

83

96

The average remaining lease terms for the Group and the Company are 3 to 5 years and 4 years

(March 31, 2015 : 3 to 5 years and 5 years) respectively. For the year ended December 31, 2015, the

average effective borrowing rates for both the Group and the Company were 4.3% to 5.2% (March

31, 2015 : 4.2% to 6.4%) per annum. Interest rates are fixed at the contract date, and thus expose

the Group and Company to fair value interest rate risk. All leases are on a fixed repayment basis and

no arrangements have been entered into for contingent rental payments.

The fair values of the Group’s and Company’s lease obligations approximate their carrying amounts.

23 CONVERTIBLE BONDS

On October 4, 2011, the Company issued $137,264,000 (equivalent to US$113,800,000), 2.5%

convertible bonds. The convertible bonds entitle the holders to convert them into ordinary shares

of the Company (unless previously redeemed, converted or purchased and cancelled) at any time on

or after October 4, 2011 up to the close of business on September 28, 2016 at a conversion price

(subject to adjustments) of $0.450 per share at a fixed exchange rate of $1.20619 per US$. Unless

previously redeemed, purchased or cancelled, the convertible bonds will be redeemed on October

3, 2016. Interest of 2.5% will be paid annually in arrears with the first interest payment date falling on

October 3, 2012.

Unless previously redeemed or converted and cancelled, the convertible bonds will be redeemed

at a redemption price equivalent to United States dollars (“USD”) principal amount plus accrued

interest at 100 per cent on the maturity. Meanwhile, the holders will have a right to require the

Company to redeem the bonds at a redemption price equivalent to USD principal amount together

with the interest accrued on that date following occurrence of relevant events (as defined in the

Offering Circular).