NOTES TO

FINANCIAL STATEMENTS

December 31, 2015

126

CITIC ENVIROTECH LTD.

Annual Report

2015

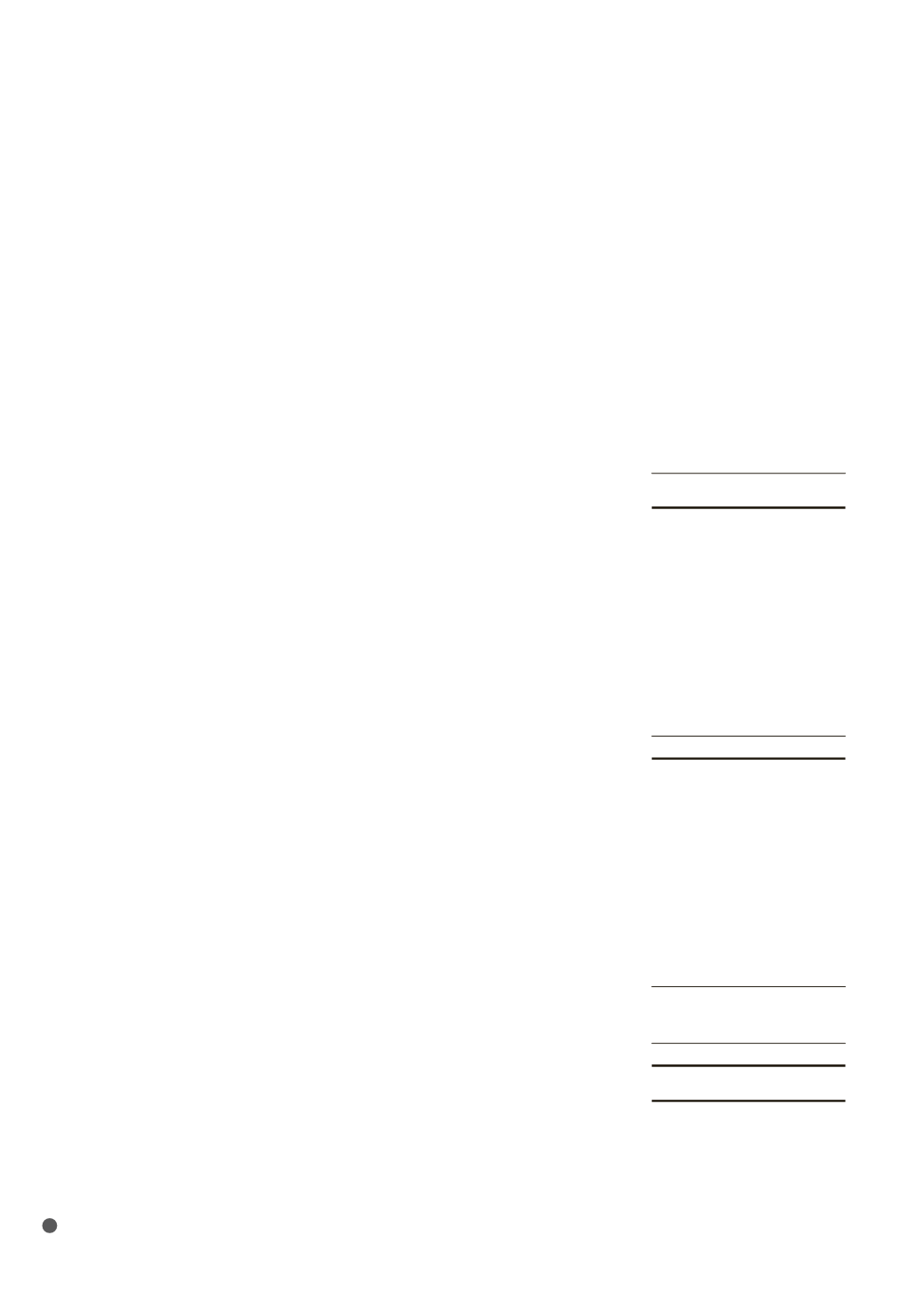

34 INCOME TAX EXPENSE (cont’d)

(b) The income tax expense varied from the amount of income tax expense determined by

applying the Singapore domestic income tax rate of 17% (March 31, 2015 : 17%) to profit

before income tax as a result of the following differences:

Group

April 1,

April 1,

2015 to 2014 to

December

31,

March

31,

2015

2015

$’000

$’000

Profit before income tax

61,471

79,911

Tax expense at the Singapore domestic income tax rate of 17%

10,450

13,585

Tax effect of expense that are not deductiblein determining

taxable profits

2,783

2,054

Deferred tax benefit not recognised

3,655

1,088

Effect of different tax rates of subsidiaries operating in other

jurisdictions

1,423

2,241

Tax exempt income

(1,021)

(1,508)

Underprovision in prior years

134

39

Withholding tax

388

368

Others

1,049

(387)

Total

18,861

17,480

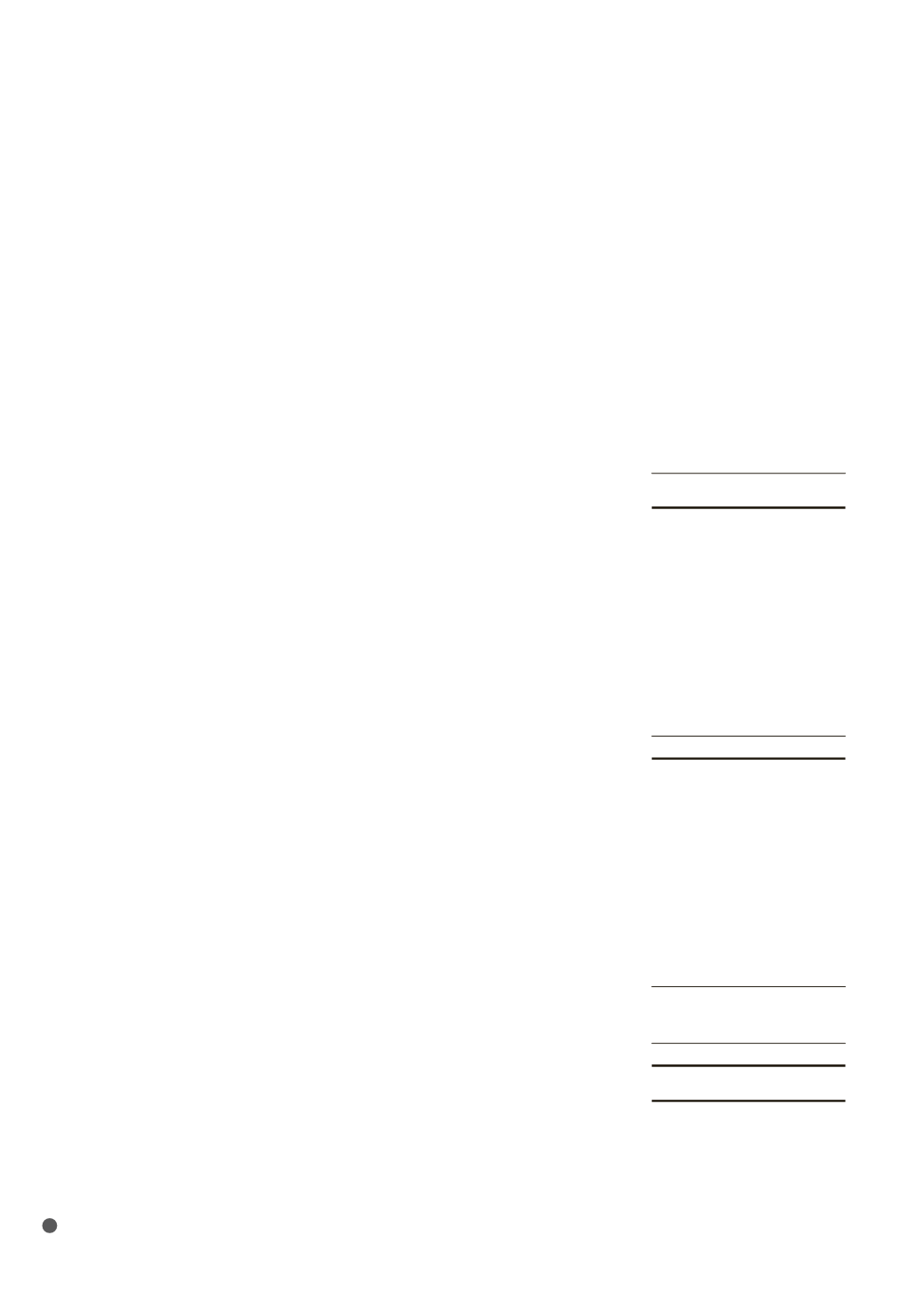

The Group has tax losses carry forwards available for offsetting against future taxable income

as follows:

Group

April 1,

April 1,

2015 to 2014 to

December

31,

March

31,

2015

2015

$’000

$’000

Amount at beginning of year

30,867

26,515

Amount arising

18,715

4,352

Amount at end of year

49,582

30,867

Deferred tax benefit on above unrecorded

10,274

5,595