NOTES TO

FINANCIAL STATEMENTS

December 31, 2015

78

CITIC ENVIROTECH LTD.

Annual Report

2015

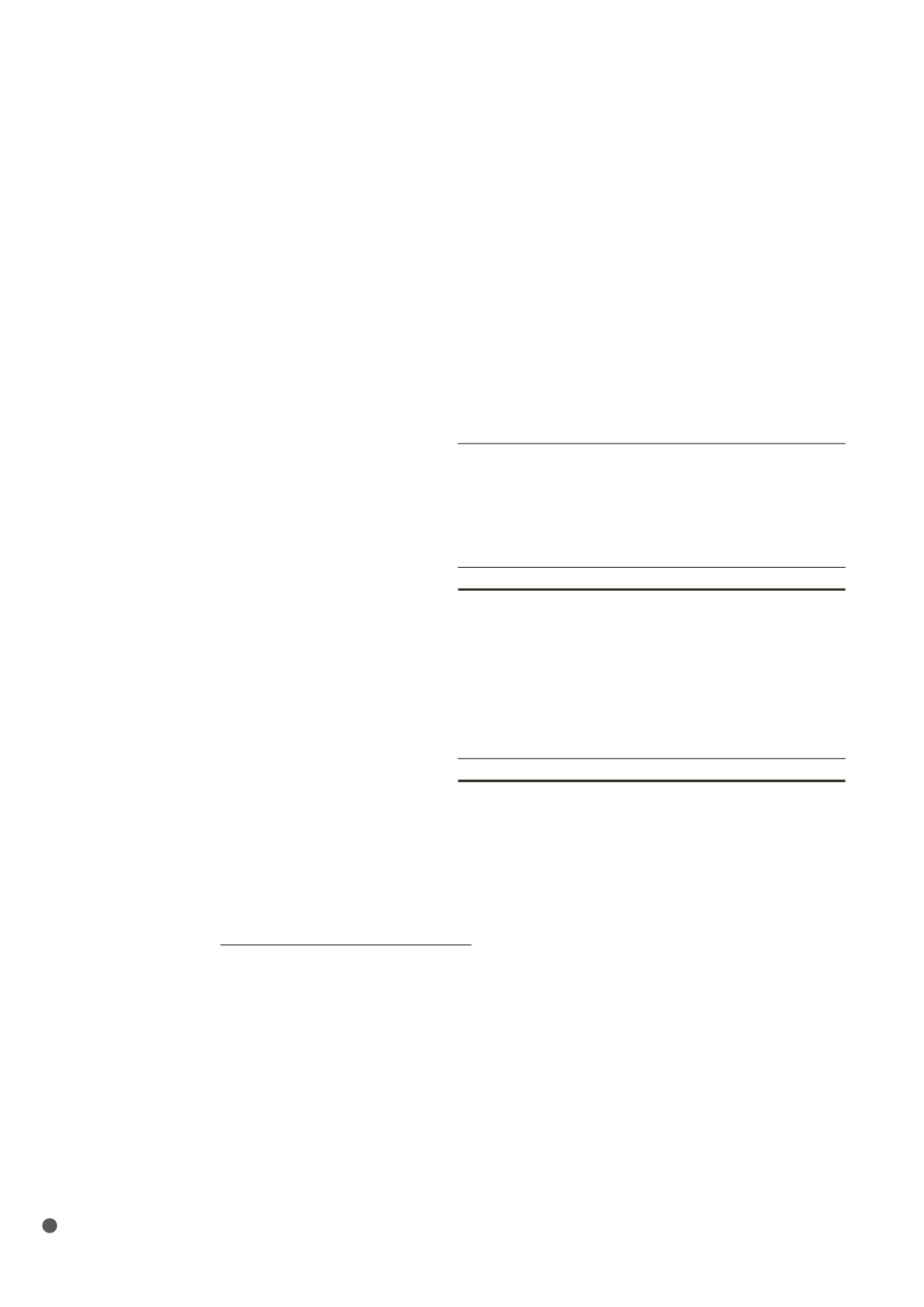

4 FINANCIAL INSTRUMENTS, FINANCIAL RISKS AND CAPITAL RISKS

MANAGEMENT (cont’d)

(c)

Categories of financial instruments

The following table sets out the financial instruments as at the end of the reporting period:

Group

Company

December

31,

2015

$’000

March 31,

2015

$’000

December

31,

2015

$’000

March 31,

2015

$’000

Financial assets

Service concession receivables

509,161 389,590

–

–

Loans and receivables

281,234 266,481 732,231 471,839

Cash and bank balances

540,466 113,757 198,024

17,530

Financial guarantee contract

–

–

2,424

2,294

Total

1,330,861 769,828 932,679 491,663

Financial liabilities

Trade payables

149,623 121,653

–

–

Other payables

73,817

95,386

21,071

35,132

Bank loans

425,751 220,774

–

1,350

Finance leases

436

227

100

112

Convertible bonds

–

58,782

–

58,782

Medium term notes

319,926

98,228 319,926

98,228

Total

969,553 595,050 341,097 193,604

(d)

Financial risk management policies and objectives

Management of the Group monitors and manages the financial risks relating to the operations

of the Group to minimise adverse potential effects of financial performance. These risks

include market risk (including currency risk, interest rate risk and equity price risk), credit risk,

liquidity risk and cash flow interest rate risk.

(i)

Foreign exchange risk management

The principal entities in the Group transact businesses significantly in Renminbi (“RMB”),

which are also the functional currencies of its principal entities and therefore the

exposure to foreign currency risk is mainly due to United States Dollar (“US$”), Malaysia

Ringgit (“RM$”), Hong Kong Dollar (“HK$”) and Singapore Dollar (S$).

Management monitors the foreign exchange exposure and will consider any hedging

should the need arises.